- SMB Current - Accounting Edition

- Posts

- SMB Current - Accounting Edition - August 2025

SMB Current - Accounting Edition - August 2025

brought to you by Tupelo

Back-to-School Isn’t Just for the Kids

As students gear up for a new semester, it’s a good time for accounting pros to hit refresh too. Whether you're reviewing client strategies before year-end or exploring ways to grow your practice, this month’s edition is packed with practical tools and insights to help you stay ahead.

Here’s what we’re covering:

• The latest industry updates (including key tax changes)

• New valuation multiples + how to get a free report

• An AI tool worth adding to your tech stack

• Actionable tips for growing your firm—efficiently

Let’s dive in 👇.

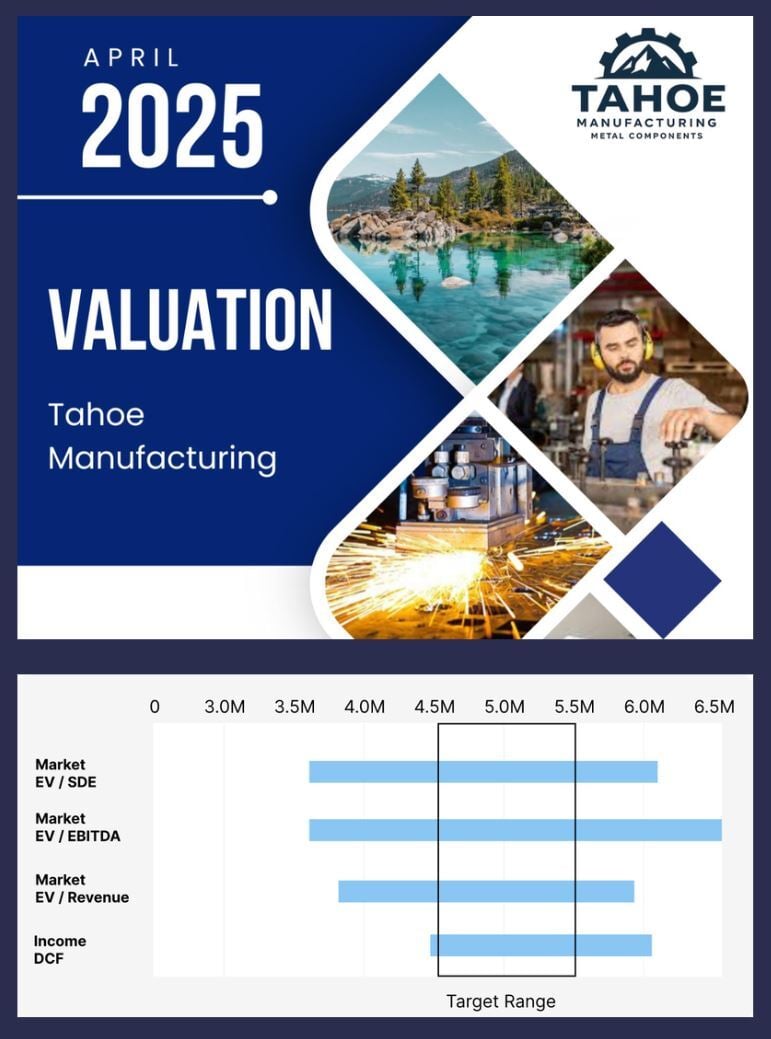

Did you know? 80% of businesses that go to market never sell. The top reasons?? Owners don’t know what their business is worth or how to sell it. Tupelo gives you real-time insight into your business valuation, so you’re always prepared.

Curious? Check out a sample valuation here:

|

📰 Accounting Press

Direct File Gets Directed to the Exit, PCAOB Hits the Brakes, and AI Anxiety Looms

No Free Lunch for Taxpayers

Federal tax news: IRS Commissioner Billy Long confirmed this week that the free Direct File tax‑filing service is officially done. Though the program served over 300K filers in 2025 across 25 states, it was axed under the incoming "Big Beautiful Bill" and replaced with a $15M program to explore public‑private alternatives. Activists and ex‑IRS engineers are already suing to resurrect the open‑source code—but as of now, taxpayers will need to rely on third‑party tools next season.

One Big Beautiful Bill for Small Business

Signed July 4, 2025, the OBBB Act locks in the 2017 tax cuts permanently and turbocharges benefits for small‑business clients: a permanent 20% QBI deduction, expanded SALT caps (up to $40,000 through 2029), and bonus depreciation fully reinstated for assets placed in service after January 19, 2025. It also allows eligible small businesses to retroactively claim the Section 174 R&E deduction back to 2022—potentially triggering amended returns and refunds.

AI on the Radar

AI usage among small and mid-size firms doubled to about 19–21% in 2025. Most common use cases: tax research, return prep, bookkeeping workflows, and document summarization. Survey says: 81% of accountants find AI boosts productivity, and 79% expect advisory services to balloon as automation handles the grunt work.

Workforce Crunch to Certification Cures?

The accounting talent pool remains tight. A few state boards passed tweaks to the 150‑hour CPA requirement to soften entry barriers. Firms are also competing with flex schedules and student‑debt repayment perks to lure Gen Z number‑crunchers.

Bottom line: Free filing is fading, regulators are recalibrating, and AI is pressing—meanwhile CPAs brace for more scrutiny, more tech, and fewer freebie options.

🛠️ Accounting & Bookkeeping AI Tool of the Month

Bluebook: AI Agents for Accountants

Bluebook builds AI agents for accounting firms—think tireless software assistants that reconcile accounts, chase down data, research tax rules, and close books while you sleep. They plug right into your existing systems, cutting hours of manual work and freeing teams to focus on the billable, high‑impact stuff. Faster closes, smoother workflows, and more time for clients—not coffee refills.

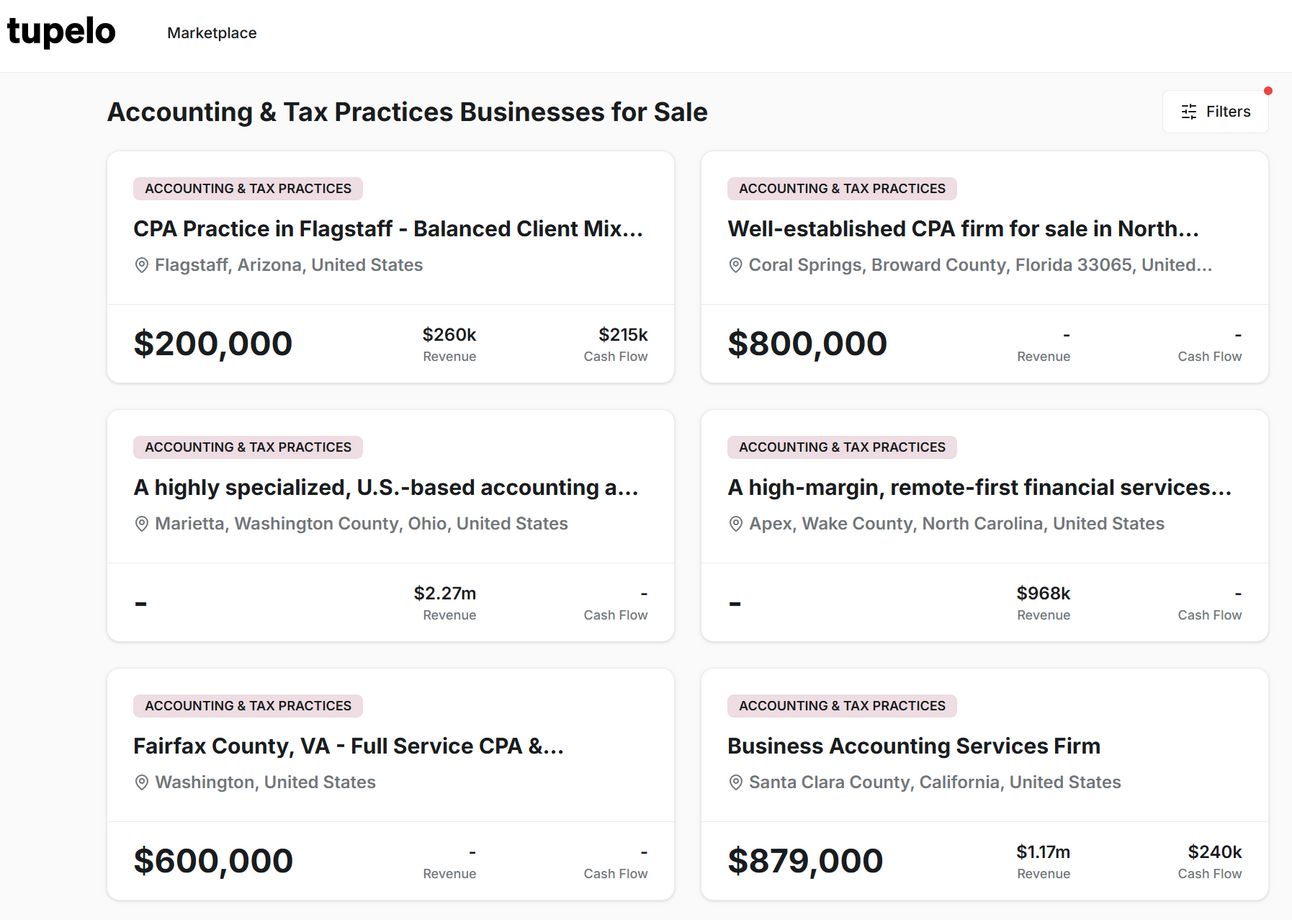

🏬 Active Listings Marketplace

Have you checked out Tupelo’s Active Listings Marketplace? See anything you like? Click on the listings below and inquire!

🦜SMB Squawk Box

Summer Edition

Click on the links below for more! | Low | Mean | Median | High |

1.60x | 2.47x | 2.30x | 5.60x | |

1.70x | 2.10x | 2.20x | 3.70x | |

1.70x | 2.55x | 2.50x | 6.80x | |

1.20x | 1.98x | 1.80x | 4.25x | |

1.40x | 2.18x | 2.00x | 5.10x |

Industry Overview, Market Size/Projections, Key Financial Metrics, Future Outlook and more | Tupelo’s industry reports get thousands of views monthly by owners, buyers, and your fellow brokers. |

Tupelo offers proprietary business valuations. This introductory call will outline the next steps and help determine if we’re a good fit to work together. Looking forward to discussing your business valuation.

👉️Growing your practice Tip

Stop Selling, Start Showing

Most accountants tell prospects what they do. The standout firms? They show them.

If you’ve helped a business owner save money, scale up, or sleep better at night—don’t keep it a secret. Case studies don’t need to be long or fancy. A short breakdown of a real win can do more to build trust than a 30-minute pitch.

Structure it like this:

The client: 2–3 words on who they are (e.g., “e-commerce seller” or “multi-location clinic”)

The problem: What challenge they came in with

The solution: What you did and how

The result: Real-world impact (think: dollars saved, time freed up, risk reduced)

🎯 Pro Tip:

Turn each case study into a content asset.

Post it on LinkedIn with a simple “here’s how we helped” hook

Add a Testimonials or Case Studies section to your website

Drop one into your next email to a prospect with a similar business

You’re already doing the work—now make it work for you.

George Wellmer, CEO Tupelo |