- SMB Current - Accounting Edition

- Posts

- SMB Current - Accounting Edition - July 2025

SMB Current - Accounting Edition - July 2025

brought to you by Tupelo

Q3 Already? Blink and It’s 2026.

It feels like 2025 just started, but here we are—Q3 is here, and the pace isn’t slowing down. Between shifting tax rules, rising AI adoption, and volatile deal activity, accountants are navigating more moving parts than ever.

Welcome back to SMB Current – Accounting Edition.

This month, we’re diving into exactly what you’ve been asking for:

👁️ Industry insights

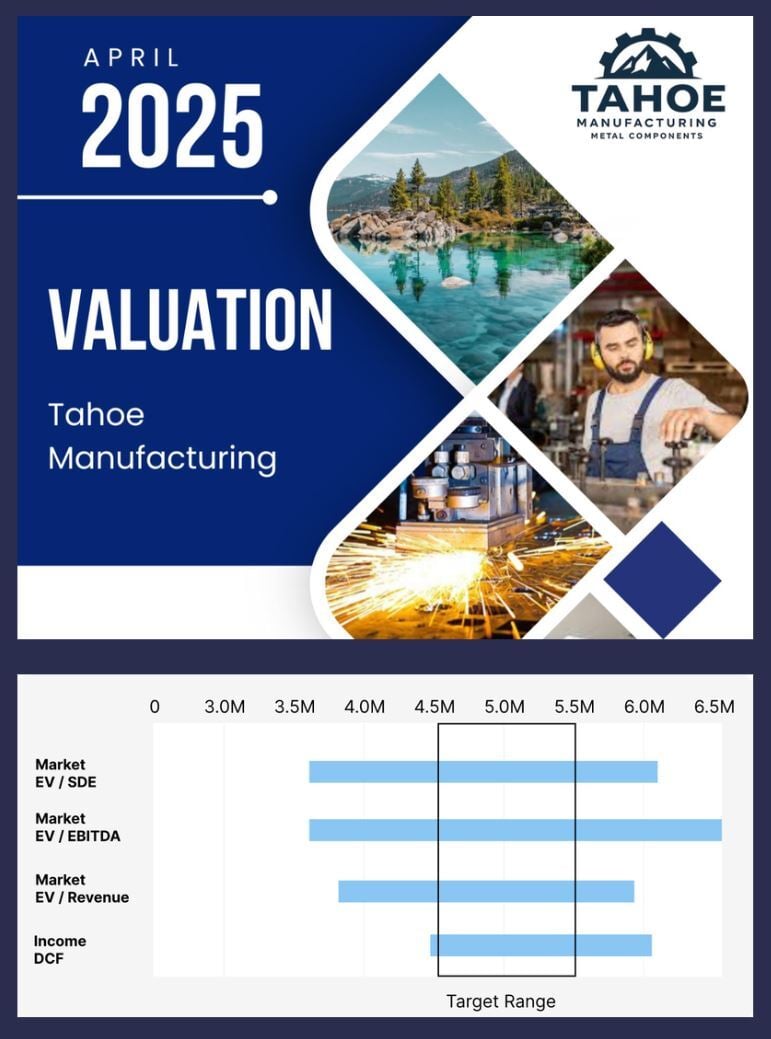

📈 Valuation multiples

🧰 AI tools for accountants

✨ Free valuation reports

Let’s get into it.

Did you know? 80% of businesses that go to market never sell. The top reasons?? Owners don’t know what their business is worth or how to sell it. Tupelo gives you real-time insight into your business valuation, so you’re always prepared.

Curious? Check out a sample valuation here:

|

📰 Accounting Press

Tax Bill 2.0 Becomes Law, AI on the Rise, and an Auditing Reprieve

Washington has delivered a tax code sequel. Congress gave final approval to the “One Big Beautiful Bill” (OBBB) Act in razor-thin votes – 51–50 in the Senate and 218–214 in the House – and President Trump signed it into law on July 4th. The measure cements the 2017 tax cuts while tossing in new perks (from tax-free tips and overtime pay to breaks on car loan interest and senior benefits).

Supporters are touting big economic payoffs. They predict record job and wage growth, with typical families seeing over $10,000 more in annual take-home pay. But skeptics warn about the hefty price tag – the Congressional Budget Office estimates OBBB will add $3.4 trillion to federal deficits over the next decade – raising concerns about fiscal risks ahead.

What’s Inside:

Auditing Reprieve: In a win for auditors, the final bill stripped out a controversial provision that would have defunded the PCAOB (the audit industry’s watchdog). A Senate referee (parliamentarian) found the PCAOB-abolition plan violated reconciliation rules, so the agency lives to audit another day.

Accounting Profession Wins: The OBBB contains several provisions that the accounting industry had pushed for, which the AICPA hailed as “beneficial to the accounting profession”. It permanently extends key tax breaks from 2017 – for example, making 100% bonus depreciation and the 20% qualified business income deduction (Sec. 199A) permanent – and even removes the cap on state and local tax deductions for pass-through entities. These changes give CPAs more certainty in long-term tax planning for businesses and individuals, ensuring popular deductions remain available and stable.

Eased Compliance Burdens: The new law rolls back certain IRS reporting requirements that would have created extra work for accountants. Notably, it restores the Form 1099-K third-party transaction reporting threshold to the previous $20,000 and 200 transactions (instead of letting it drop to $600). It also raises the general Form 1099 reporting cutoff from $600 up to $2,000 for payments to contractors and others. By reducing the number of small-dollar transactions that trigger tax forms, OBBB spares accountants and small businesses a flood of paperwork in future filing seasons.

🛠️ Accounting & Bookkeeping AI Tool of the Month

Botkeeper is an AI-powered platform that automates core bookkeeping tasks—bank reconciliations, payroll entries, invoicing, financial reporting—all while integrating smoothly with QuickBooks and Xero. Behind the automation is a layer of human oversight to ensure accuracy and handle edge cases.

Accounting firms use Botkeeper to streamline routine workflows, reduce manual data entry, and scale operations without additional hires. Real-time dashboards provide visibility across clients and tasks, helping teams stay on track and focus more on advisory work. The result: fewer bottlenecks, more strategic capacity, and better team morale.

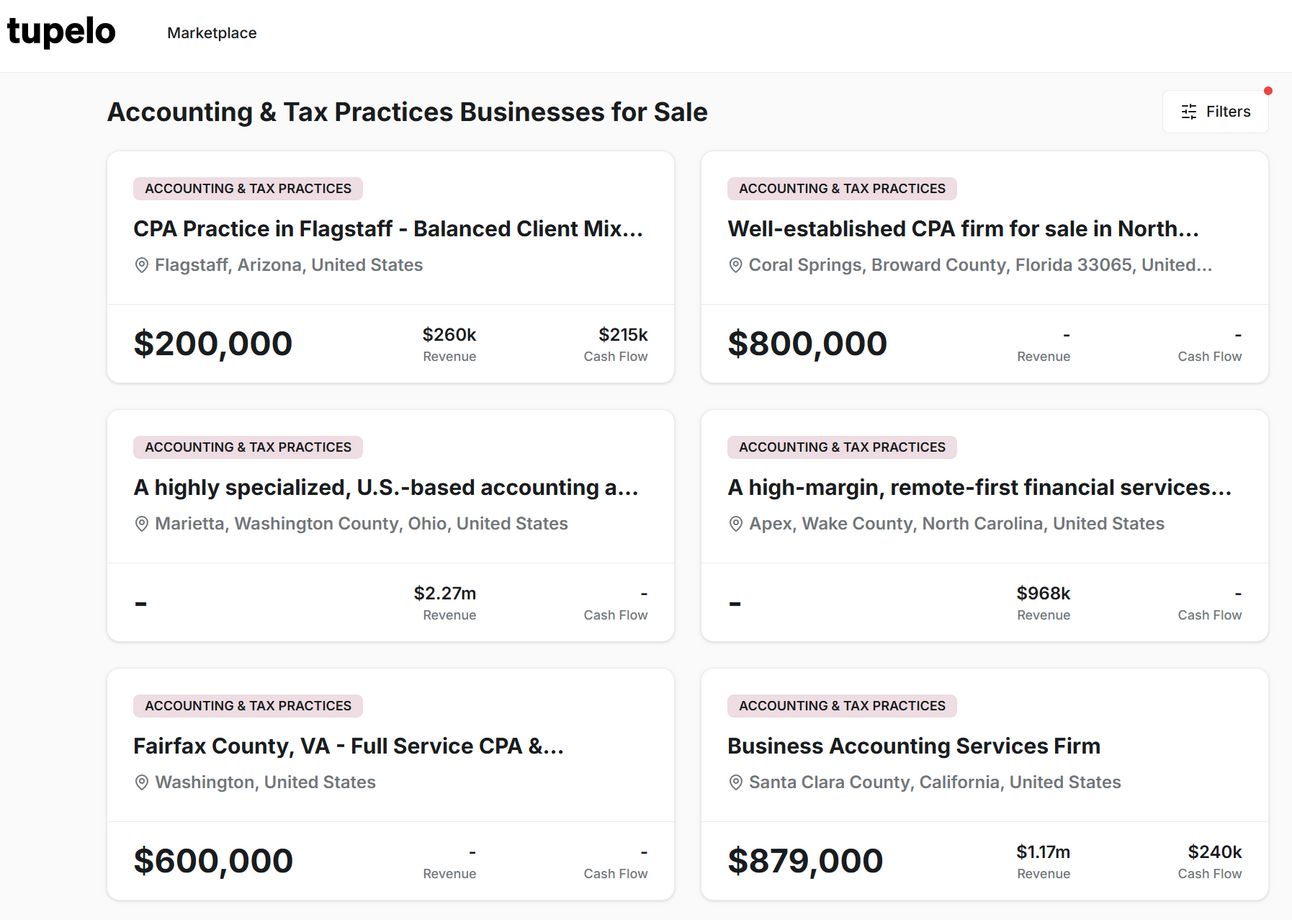

🏬 Active Listings Marketplace

Have you checked out Tupelo’s Active Listings Marketplace? See anything you like? Click on the listings below and inquire!

🦜SMB Squawk Box

Construction - Seller Discretionary Earnings

Click on the links below for more! | Low | Mean | Median | High |

1.10x | 1.82x | 1.60x | 4.30x | |

1.60x | 2.47x | 2.40x | 4.90x | |

2.05x | 3.40x | 3.30x | 5.90x | |

1.80x | 2.47x | 2.30x | 5.20x |

Industry Overview, Market Size/Projections, Key Financial Metrics, Future Outlook and more | Tupelo’s industry reports get thousands of views monthly by owners, buyers, and your fellow brokers. |

Tupelo offers proprietary business valuations. This introductory call will outline the next steps and help determine if we’re a good fit to work together. Looking forward to discussing your business valuation.

👉️Growing your practice Tip

Niche Down, Level Up

The fastest-growing accounting firms are specialists - or at least that is what their target market thinks.

Whether it’s e-commerce, healthcare, real estate, or whatever else, niche-focused advisory services are in demand. Use tools like Sage Intacct or Zoho Books to unlock industry-specific insights—think SKU-level profitability for online stores or cash flow forecasting for clinics.

🎯 Pro Tip: Turn your insights into client magnets. Webinars, short LinkedIn posts, or blog articles tailored to each niche can attract exactly the clients you want—and justify charging more for doing less.

Niche | Common Need | Potential Solution |

E-commerce | Product pricing & returns | SKU-level insights via Sage Intacct |

Healthcare | Cash flow + AR management | Forecasting tools |

Real Estate | Asset depreciation | Industry-specific reporting |

George Wellmer, CEO Tupelo |