- SMB Current - Accounting Edition

- Posts

- SMB Current - Accounting Edition - October 2025

SMB Current - Accounting Edition - October 2025

brought to you by Tupelo

Pumpkin spice is back, leaves are turning—and Washington’s floors look to be shutting down. 🍁

Meanwhile, your accounting world is anything but sleepy. This month we’re diving into fresh tax changes from the One Big Beautiful Bill, phasing out paper refund checks (finally), and scanning the horizon for AI tools, M&A multiples, and practice-growth tips. 2025 is already rewriting the rulebook, and with a full quarter left, the plot’s just getting good.

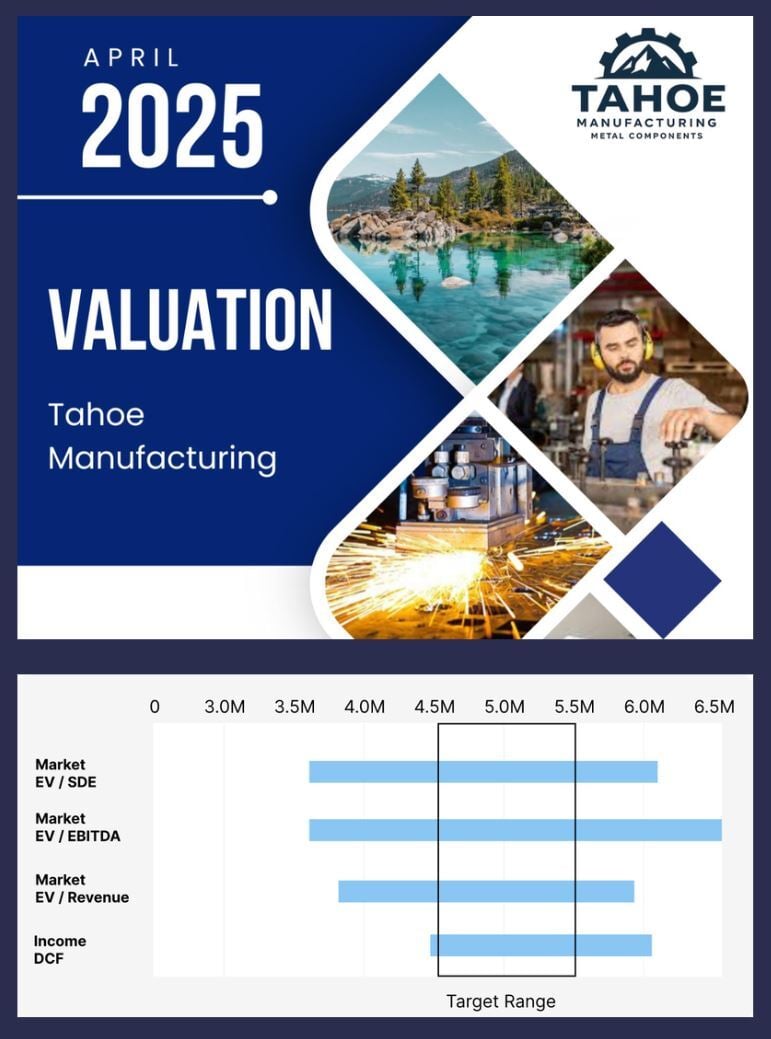

Did you know? 80% of businesses that go to market never sell. The top reasons?? Owners don’t know what their business is worth or how to sell it. Tupelo gives you real-time insight into your business valuation, so you’re always prepared.

Curious? Check out a sample valuation here:

|

📰 Accounting Press

Here’s your September 2025 tax shake-up, served fresh and strong (with a side of CPA caffeine): Congress passed the One Big Beautiful Bill Act (OBBBA), and it’s not just a pretty name. If your client works overtime under FLSA, they now may deduct the “extra half-time” portion (above their regular rate) of that pay — up to $12,500 (or $25,000 married filing jointly). That means your inbox might light up with questions: what qualifies, which jobs count, and how solid must their records be.

Tipped workers also get relief: under new “no tax on tips” rules, qualified cash tips may now enjoy a deduction in eligible occupations (though the IRS must clarify which jobs qualify and what counts as “qualified tip”).

Meanwhile, the IRS is phasing out paper refund checks as of September 30, 2025. Taxpayers will need to receive refunds electronically (e.g. direct deposit, prepaid debit card, or other secure digital methods) except in limited hardship or waiver cases. If your clients haven’t gone digital yet, now’s the time — otherwise their refunds may go missing in the mail.

On other fronts:

The SALT deduction cap is raised to $40,000 in 2025 (with modest annual increases through 2029) before reverting to $10,000 in 2030; higher-income taxpayers face a phaseout;

Interest on personal car loans (for new U.S.-assembled vehicles) becomes deductible (up to $10,000) for 2025–2028, subject to income limits.

Domestic R&D (R&E) expenditures may again be expensed immediately rather than amortized (foreign R&D still amortizes over 15 years).

The standard deduction receives a bump (e.g. $15,750 single, $31,500 married filing jointly) under OBBBA’s new baseline.

In short: 2025 is not the year to go on autopilot. New deductions, phased rules, reporting requirements, and tighter substantiation mean advisory work, digital hand-holding, and precision will be your strongest tools. Stay sharp, stay caffeinated — and yes, keep refreshing the rulebooks.

🛠️ Accounting & Bookkeeping AI Tool of the Month

Numeric: AI-powered Accounting

Numeric is an AI-powered accounting software that helps companies close their books quickly and accurately. Instead of spending days chasing down transactions and updating spreadsheets, accountants use Numeric to connect directly to their accounting systems, track the numbers in real time, and spot issues before they become problems. The software uses AI to flag anything unusual and prepares the reports teams need, so month-end closes take less time and come with fewer mistakes.

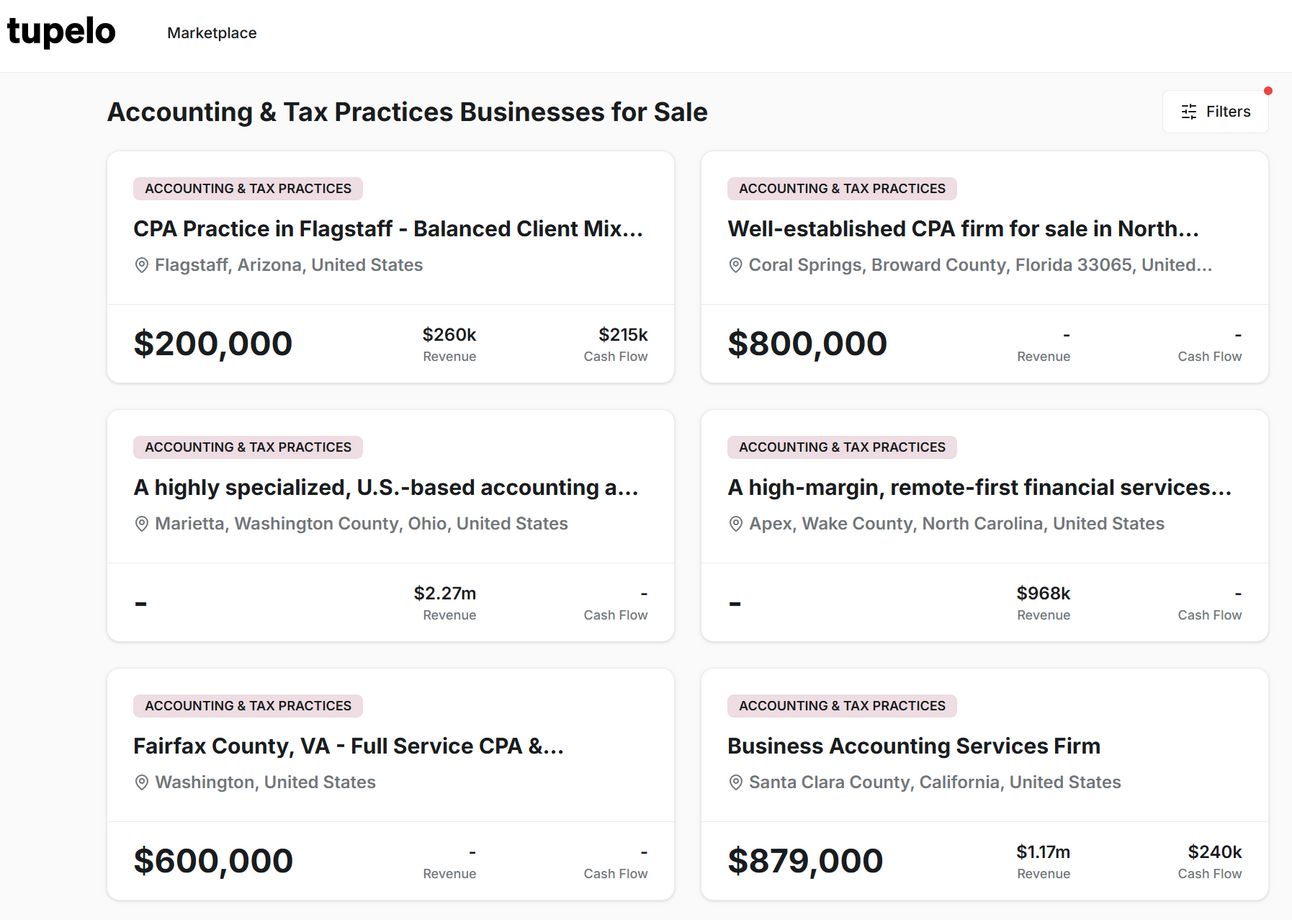

🏬 Active Listings Marketplace

Have you checked out Tupelo’s Active Listings Marketplace? See anything you like? Click on the listings below and inquire!

🦜SMB Squawk Box

Manufacturing - Seller Discretionary Earnings

Football Edition

Click on the links below for more! | Low | Mean | Median | High |

2.00x | 3.34x | 3.80x | 4.80x | |

1.70x | 2.10x | 2.20x | 3.70x | |

1.20x | 1.98x | 1.80x | 4.25x | |

1.35x | 2.00x | 2.00x | 4.60x |

Industry Overview, Market Size/Projections, Key Financial Metrics, Future Outlook and more | Tupelo’s industry reports get thousands of views monthly by owners, buyers, and your fellow brokers. |

Tupelo offers proprietary business valuations. This introductory call will outline the next steps and help determine if we’re a good fit to work together. Looking forward to discussing your business valuation.

👉️Growing your practice Tip

Advisory Advisory Advisory - be your clients CFO

Small businesses crave strategic financial insight but can’t justify a full-time CFO. Enter you: the virtual CFO. Think cash-flow forecasting, pricing strategy, and “should-we-expand?” modeling—CFO-level brains on a fractional budget. Demand is surging (requests for virtual CFOs are up triple digits), and clients pay premium monthly retainers for ongoing guidance.

Package it. Market the value (dashboards, KPI tracking, strategy). Price on impact, not hours. You become a key partner—not just the person who files their taxes.

George Wellmer, CEO Tupelo |